Interest Rates & Charges

Our Master Credit Policy has the factors affecting the risk grading/interest rate of the customers.

These factors also impact the pricing on loans.

A. Factors affecting Pricing for all products

- Loan Amount

- Loan Tenor

- Credit History

- Existing Relationship

B. Additional Factors affecting Pricing for each Product as listed below in the table

| Product | Additional Factors considered for Pricing |

| Unsecured Business Loans | Location of the Borrower (City Tier), Audited Financials / GST Status |

| Salaried Personal Loans | Job / Employer Classification, Salary Band |

| Gold Loans | Ornament Type, Gold Purity |

| Vehicle Loans (CV, CE, TRL, TW) | Asset Vintage, Asset Type, Customer Segmentation, Asset OEM Partnership |

| Sales Finance (CD, DPL, LSL) | Asset OEM Partnership |

| LAP / LARR / EBL | Applicant Profile, Collateral Type, Collateral Location |

| Product | Interest Rate (p.a.) |

| Commercial Vehicles Loan | 8.00% to 26.00% |

| Construction Equipment Loan | 8.00% to 24.00% |

| Tractor Loan | 9.00% to 25.00% |

| Auto Loan | 8.00% to 26.00% |

| Two Wheeler Loan | 9.00% to 32.00% |

| All Unsecured Loans | 10.00% to 35.00% |

| Loan against Gold | 8.50% to 25.00% |

| Loan Against Securities | 10.00% to 18.00% |

| Micro Loans | 25.00% |

| Consumer Durable Loan | 8.00% to 38.00% |

| Digital Product Loan | 8.00% to 38.00% |

| Lifestyle Product Loan | 8.00% to 38.00% |

| Loan Against Property/Rent Receivables | 8.00% to 20.00% |

| Enterprise Business Loan | 10.00% to 36.00% |

The Rate of Interest on your loan will be based on the parameters specified in the Interest Rate Policy of the Company, which is available on the website of the Company.

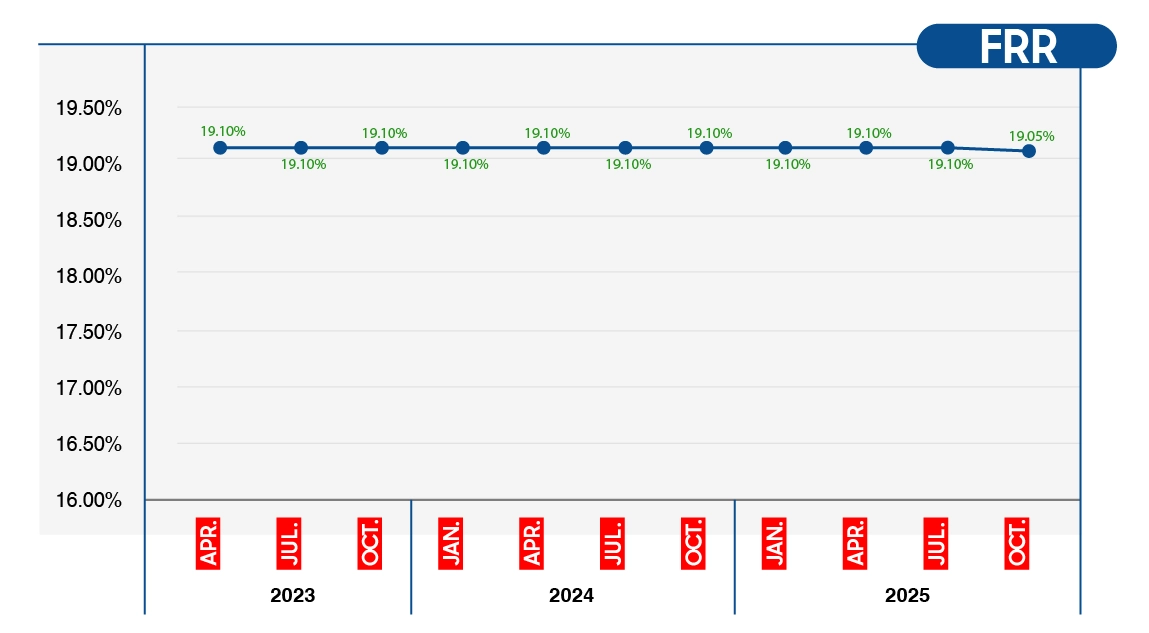

Floating Rate of Interest, when applicable to the loan facility, shall mean the Floating Reference Rate (FRR) applied to the facility with spread (if any) as specified in the Loan Agreement.

FRR is reset every Quarter, on the 1st of April, 1st of July, 1st of October, 1st of January of every year.

FRR as on July 1st, 2025: 19.10% per annum

FRR as on October 1st, 2025: 19.05% per annum

Next revision Date: January 1st, 2026

All Customers who are under FRR and want to shift to MRR can visit nearest HDBFS Branch.

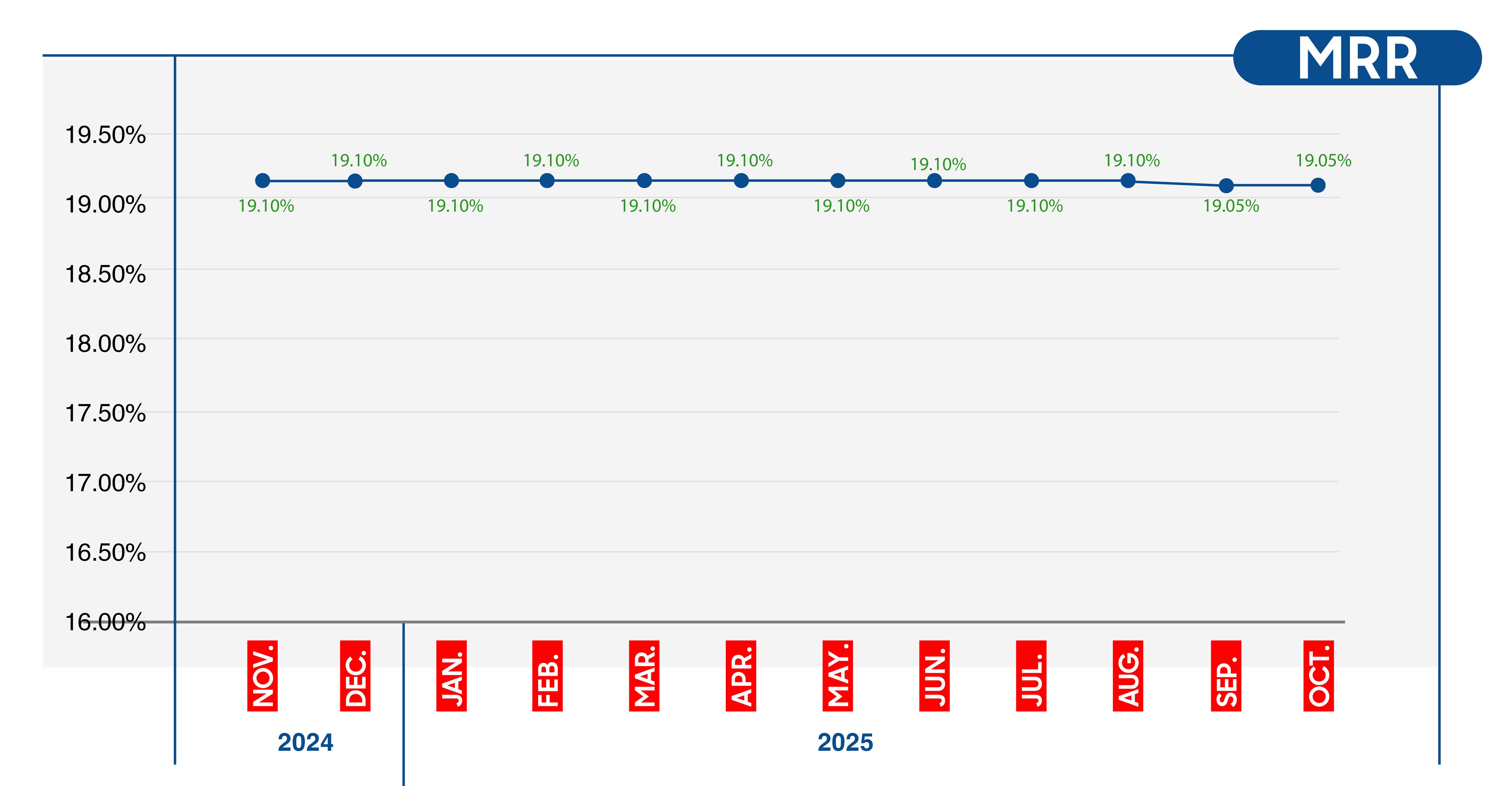

Monthly Reference Rate , when applicable to the loan facility, shall mean the Monthly Reference Rate (MRR) applied to the facility with spread (if any) as specified in the Loan Agreement.

MRR is reset every Month, on the 15th of every Month.

MRR as on October 15th, 2025: 19.05% per annum

All Customers who are under FRR and want to shift to MRR can visit nearest HDBFS Branch.

| ParticularsParticulars | Personal Loan | LAP | EBL | CDL / DPL | Gold Loan | Auto Loan | LAS | CV / CEL | Tractor Loan | TW |

|---|---|---|---|---|---|---|---|---|---|---|

| APPLICATION FEE (up to Rs / per Asset)APPLICATION FEE (up to Rs / per Asset) |

up to Rs. 3,500 |

up to Rs. 7,670 |

up to Rs. 7,670 |

up to Rs. 100 |

NA | up to Rs. 5,900 |

up to Rs. 5,900 |

up to Rs. 5,900 |

up to Rs. 5,900 |

up to Rs. 500 |

| LOAN PROCESSING FEE LOAN PROCESSING FEE |

up to 5.90% | up to 2.36% | up to 3.54% | up to 5.90% | up to 2.36% | up to 3.54% | up to 2.36% | up to 3.54% | up to 3.54% | up to 5.90% |

| CHEQUE / ACH BOUNCE CHARGES

(p.b.)CHEQUE / ACH BOUNCE CHARGES (p.b.) |

Rs. 885 | Rs. 885 | Rs. 885 | Rs. 472 | Rs. 236 | Rs. 885 | Rs. 885 | Rs. 885 | Rs. 885 | Rs. 885 |

| DELAYED INSTALLMENT PAYMENT CHARGE (P.A)^DELAYED INSTALLMENT PAYMENT CHARGE (P.A)^ |

35.40% | 35.40% | 35.40% | 35.40% | 35.40% | 35.40% | 35.40% | 35.40% | 35.40% | 35.40% |

| PDC / ACH SWAP CHARGES (p.s)PDC / ACH SWAP CHARGES (p.s) |

Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 |

| STATEMENT OF ACCOUNT CHARGES - Through Mobile App & Web

AppSTATEMENT OF ACCOUNT CHARGES - Through Mobile App & Website |

NIL | NIL | NIL | NIL | Nil | NIL | NIL | NIL | NIL | NIL |

| STATEMENT OF ACCOUNT CHARGES - Through other

ChannelsSTATEMENT OF ACCOUNT CHARGES - Through other Channels |

Rs. 590 | Rs. 590 | Rs. 590 | Rs. 236 | Rs. 236 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 |

| DOCUMENT RETRIEVAL CHARGESDOCUMENT RETRIEVAL CHARGES |

Rs. 885 | Rs. 885 | Rs. 885 | Rs. 885 | NA | Rs. 885 | Rs. 885 | Rs. 885 | Rs. 885 | Rs. 885 |

| COPY OF PROPERTY/ SECURITY PAPERSCOPY OF PROPERTY/ SECURITY PAPERS |

NA | Rs. 885 | Rs. 885 | NA | NA | Rs. 885 | Rs. 885 | Rs. 885 | Rs. 885 | NA |

| NOC REVALIDATION CHARGESNOC REVALIDATION CHARGES |

NA | NA | NA | NA | NA | Rs. 590 | NA | Rs. 590 | Rs. 590 | Rs. 590 |

| COPY OF DOCUMENTS (issued at the time of loan

disbursement)COPY OF DOCUMENTS (issued at the time of loan disbursement) |

Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 | Rs. 590 |

|

CHARGES |

Rs. 1,180 | Rs. 8,850 | Rs. 8,850 | Rs. 1,180 | Nil | Rs. 5,900 | Rs. 5,900 | Rs. 5,900 | Rs. 5,900 | Rs. 1,180 |

| CERSAI FEES (PER PROPERTY) CERSAI FEES (PER PROPERTY) |

NA | Rs. 118 | Rs. 118 | NA | NA | NA | NA | NA | NA | NA |

| PRE-PAYMENT CHARGES (AS % OF POS) PRE-PAYMENT CHARGES (AS % OF POS) |

up to 4.72% | up to 4.72% | up to 4.72% | NIL | up to 1.18%* | up to 4.72% | up to 4.72% | up to 4.72% | up to 4.72% | up to 4.72% |

| INSTALLMENT COLLECTION CHARGES (p.i.) INSTALLMENT COLLECTION CHARGES (p.i.) |

Rs. 236 | Rs. 236 | Rs. 236 | Rs. 236 | Rs. 236 | Rs. 236 | Rs. 236 | Rs. 236 | Rs. 236 | Rs. 236 |

| REPOSSESSION CHARGES (up to Rs.)# REPOSSESSION CHARGES (up to Rs.)# |

NA | up to Rs 1.5 Lacs |

up to Rs 1.5 Lacs |

NA | NA | up to Rs. 11,000 |

NA | up to Rs. 25,000 |

up to Rs. 12,000 |

up to Rs. 3,500 |

| RESCHEDULMENT CHARGES (AS % OF POS) RESCHEDULMENT CHARGES (AS % OF POS) |

1.18% | 1.18% | 1.18% | 1.18% | 1.18% | 1.18% | 1.18% | 1.18% | 1.18% | 1.18% |

| LOAN RECALL NOTICE CHARGES (p.l.) LOAN RECALL NOTICE CHARGES (p.l.) |

Rs. 2,360 | Rs. 2,360 | Rs. 2,360 | NA | Rs. 1,180 | Rs. 2,360 | Rs. 2,360 | Rs. 2,360 | Rs. 2,360 | Rs. 2,360 |

| PARKING CHARGES per day (up to Rs.) PARKING CHARGES per day (up to Rs.) |

NA | NA | NA | NA | NA | Rs. 65 | NA | Rs. 250 | Rs. 80 | Rs. 30 |

| CASH HANDLING CHARGES CASH HANDLING CHARGES |

NA | NA | NA | 1% | 1% | NA | NA | NA | NA | up to 1% |

| GOLD AUCTION CHARGES (P.A.) GOLD AUCTION CHARGES (P.A.) |

NA | NA | NA | NA | Rs. 1,770 | NA | NA | NA | NA | NA |

To view Fees & Charges for LAPCL product, Click here

Please Note:- The above charges are inclusive of applicable taxes, wherever applicable

- p.m.^ = Per Month on Overdue EMI Amount/Interest Amount

- Sarfaesi Charges of up to Rs. 35000/- applicable at time of filing for all Property backed loans. All additional costs associated with recovery will be charged to the customers account.

- Processing fee is charged on Sanctioned Loan Amount.

- Illustration of Processing Fee & Delayed Installment Payment Charge for sample cases are given in annexure.

- SOA – SF Customer: Free for 1st request. Charges for subsequent request would be Rs. 200/- per request

- # Repossession charges varies from location to location depending on property, difficulty in repossession, borrower profile and other incidental charges

- Yard Parking charges are charged on per day basis

- Cash handling charges are charged on cash received from customer for Prepayment of loan for mentioned products.

- Pre-payment charges do not apply to LAP/EBL loans granted to individual borrowers under a floating interest rate

- No pre-payment charges for Gold Loans with a repayment history of more than 18 months

- In addition to above, there is documentation charges applicable for all products under Vehicle loans. This charge is up to Rs. 2500 of the sanctioned loan amount.

- For Micro Lending product there are only two charges. (i) 1.77% Processing fee on sanctioned loan amount (ii) Account validation charge up to Rs. 5/- per bank account number validation

- With effect from April 01, 2024, no additional component can be added to the rate of interest in the form of 'Penal Interest'. There shall not be any additional rate of interest / premium / default interest payable on default by the borrower w.e.f. April 01, 2024.

- The delayed instalment payment charge for loans sanctioned to 'individual borrowers, for purposes other than business', cannot be higher than such charges applicable to non-individual borrowers.

- Convenience Charge up to Rs. 1500/- across all products.

- Stamp Duty applicable as per actuals.

- *Pre-payment charges (As % of Pos):

- up to 6 months of Repayment - 1.18%

- 7 months - 18 months of repayment - 0.59%

- Greater than 18 months of repayment - Nil

Abbreviations Used:

- Loan Against Property = LAP; EBL = Enterprise Business Loans; CDL = Consumer Durables Loans; DPL = Digital Product Loan; LSL = Life Style Loans, LAS = Loan Against Securities; CV = Commercial Vehicles; CEL = Commercial Equipments Loans; TW = Two Wheeler; LAPCL = Loan Against Property Credit Line; Txn= Transaction;

- For all value figures K - Thousand; P.A.=Per Annum; p.a.=per asset; p.b.= per bounce; p.s.=per swap; p.i.=per installment; p.l.=per loan; POS = Principal Outstanding

| Loan Tenure on Record | |||||||

|---|---|---|---|---|---|---|---|

| Product | 0-12 months | 13-36 months | Greater Than 36 months | ||||

| Loan Against Property & Enterprise Business Loan (on Fixed Rate) |

4.72% of Principal Outstanding Amount | 4.72% of Principal Outstanding Amount | 2.36% of Principal Outstanding Amount | ||||

| Loan Against Property & Enterprise Business Loan (on Floating Interest Rate) |

Non-Individual Borrowers | 4.72% of Principal Outstanding Amount | 4.72% of Principal Outstanding Amount | 2.36% of Principal Outstanding Amount | |||

| Individual Borrowers | Nil | Nil | Nil | ||||

| Product | 0-6 months | 7-18 months | Greater Than 18 months | ||||

| Loan Against Gold jewellery | 1.18% of Principal Outstanding Amount | 0.59% of Principal Outstanding Amount | Nil | ||||

|

Prepayment by cash - Cash handling charges* of Rs.1/- per Rs.118/- *Cash Payment allowed only for total loan amount up to Rs.1 lac on all loans from HDBFS. Click here to refer FAQ's |

|||||||

| Consumer Durables Loans / Digital Product Loan |

No Prepayment Prepayment by cash - Cash handling charges* of Rs.1/- per Rs.118/- *Cash Payment allowed only for total loan amount up to Rs.1 lac on all loans from HDBFS. Click here to refer FAQ's |

||||||

| Personal Loan, Auto Loan, Two Wheeler Loan, Loan Against Securities, Commercial Vehicle Loan, Construction Equipment Loan, Tractor Loan | 4.72% of Principal Outstanding Amount | 4.72% of Principal Outstanding Amount | 4.72% of Principal Outstanding Amount | ||||

Click here for Prepayment Request

Form

Taxes, as applicable, will be charged on prepayment charges