5 ways you can fund your business

5 ways you can fund your business

-

5 ways you can fund your business30 August 2019

Funding one’s business is one of the biggest challenges after customer acquisition for every entrepreneur. As a Private Limited firm, one may incur a variety of costs. These include marketing costs, infrastructure cost, equipment costs, labour costs, raw material costs, payroll costs and many more.

How does one ensure to never run out of funds when running such a business? Answer is Business Loan

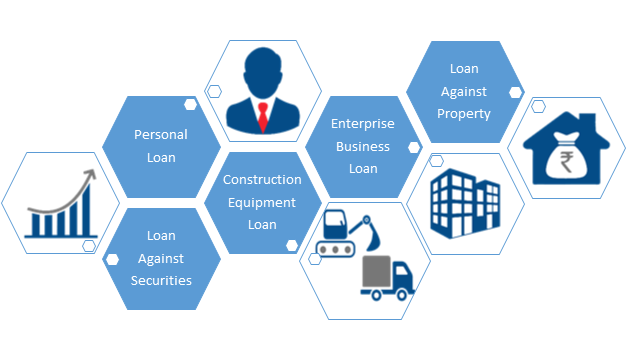

Funding Options for Private Limited Companies

1. Personal Loan

The most common type of funding option is Personal Loan. Onecan avail a loan of up to Rs. 20 lakh and use it for funding a variety of one’s business needs. These include procuring raw materials, construction or repair of one’s office infrastructure or just for giving a boost to the marketing initiatives. There are no questions asked and no guarantor or security required.

2. Loan Against Securities

If the customer owns Securities like NSC, Gold ETFs, approved DEMAT shares, approved insurance policies, etc., there’s more good news. One can avail up to 50 lakh as a loan. Through the instant credit facility, the money would be transferred in the customer’s bank account and he can choose to repay through either EMI-based option or the interest-only payment method.

3. Construction Equipment Loan/ Commercial Vehicle Loan

For those into the construction business, there are a lot of things needed besides customers. This includes a lot of huge, expensive construction equipment. HDB offers construction equipment loan that comes with up to 100% finance on the asset cost. The customers can even avail finance for used equipment and also as a top-up on their existing loan.

Those dealing with commercial vehicles as a part of their business too can avail customised financial solutions from HDB for their individual requirements. Financing for new and used vehicles such as trucks, buses, small commercial vehicles and more is now stress-free with simple documentation and easy processing. Customers also get complete assistance while purchasing the vehicle of their choice.

4. Enterprise Business Loan/ Business Loan

One of the most popular types of loan for businesses is Business Loan. HDB offers two types of loans for businesses. If customers have a business property and wish to avail a secured loan, they can go for an Enterprise Business Loan. With the convenience of doorstep service, they can avail a loan of up to Rs. 30 lakh at attractive interest rates.

If however, they don’t have a business property to pledge, they can still avail a Business Loan from HDB. It’s an unsecured loan and does not require any guarantor or collateral for availing it. One can choose from a tenure from 12-60 months and pay it back with ease.

5. LAP

Loan Against Property is for those who have a property and wish to avail a secured loan without compromising on any benefits of the property. It only acts as collateral and increases the chances of getting the loan at better terms. The interest rate in case of LAP also tends to reduce as it now is a secured loan.

Getting a business loan from a traditional bank might seem challenging due to its paperwork and complicated processes. NBFCs like HDB Financial Services Ltd not just provide customers with the best offers but also end-to-end support of funding their business in times of need. HDB’s team of dedicated professionals helps them determine their requirements, especially for small businesses and helps them get a loan in the shortest time possible. The ball now lies in their court to decide how much financial assistance their business needs and take advantage of the various funding opportunities available.